Hungary's Banking Crisis: Promises Broken, Families Betrayed

Image: MTI/Kovács Attila

Image: MTI/Kovács Attila

The European Court of Justice ruling in April delivered brutal clarity on Case C-630/23. The court confirmed what Hungarian families had fought to expose for years: banks sold them Swiss franc and euro mortgages while concealing currency risks in fine print. These loans violated EU consumer protection laws. Europe's highest court made this official.

Viktor Orbán's Fidesz should have celebrated. The ruling provided evidence that foreign banks had exploited Hungarian families, which would be perfect ammunition for their anti-globalist agenda. Instead, the ruling exposed something more troubling. When forced to choose between voters and international finance, Fidesz capitulated.

Currency markets collapsed in 2008, and Hungarian households watched their debts double overnight. A family owing 10 million forints suddenly owed 20 million. Banks collected windfall profits and families lost everything. Fifteen years later, foreclosure notices arrive daily. Fidesz controls parliament but lacks the will to stop the process.

Mi Hazánk senses opportunity and demands immediate suspension of foreclosures, and every foreign currency loan should be nullified without delay. Party specialist Fiszter Zsuzsanna stated: "We cannot bow down to the banks. Everything must be returned, and all cases must be recalculated."

The policy divide between parties is substantial. Mi Hazánk organized nationwide signature drives demanding retroactive compensation for every victim. No lawsuits. No legal fees. No waiting. Fidesz promised help in spring 2025, but what they delivered was bureaucratic theater.

In the justice committee, Fidesz-KDNP representatives killed Mi Hazánk's proposals without offering alternative solutions. No timeline. No plan. No acknowledgment that Europe's highest court had spoken. Mi Hazánk called it "cynical indifference and silence."

According to anonymous banking sources, EBRD agreements constrain Hungarian legislation. These deals, signed during EU accession talks, shield foreign banks from domestic regulation. The implication is stark: international finance takes priority over Hungarian sovereignty.

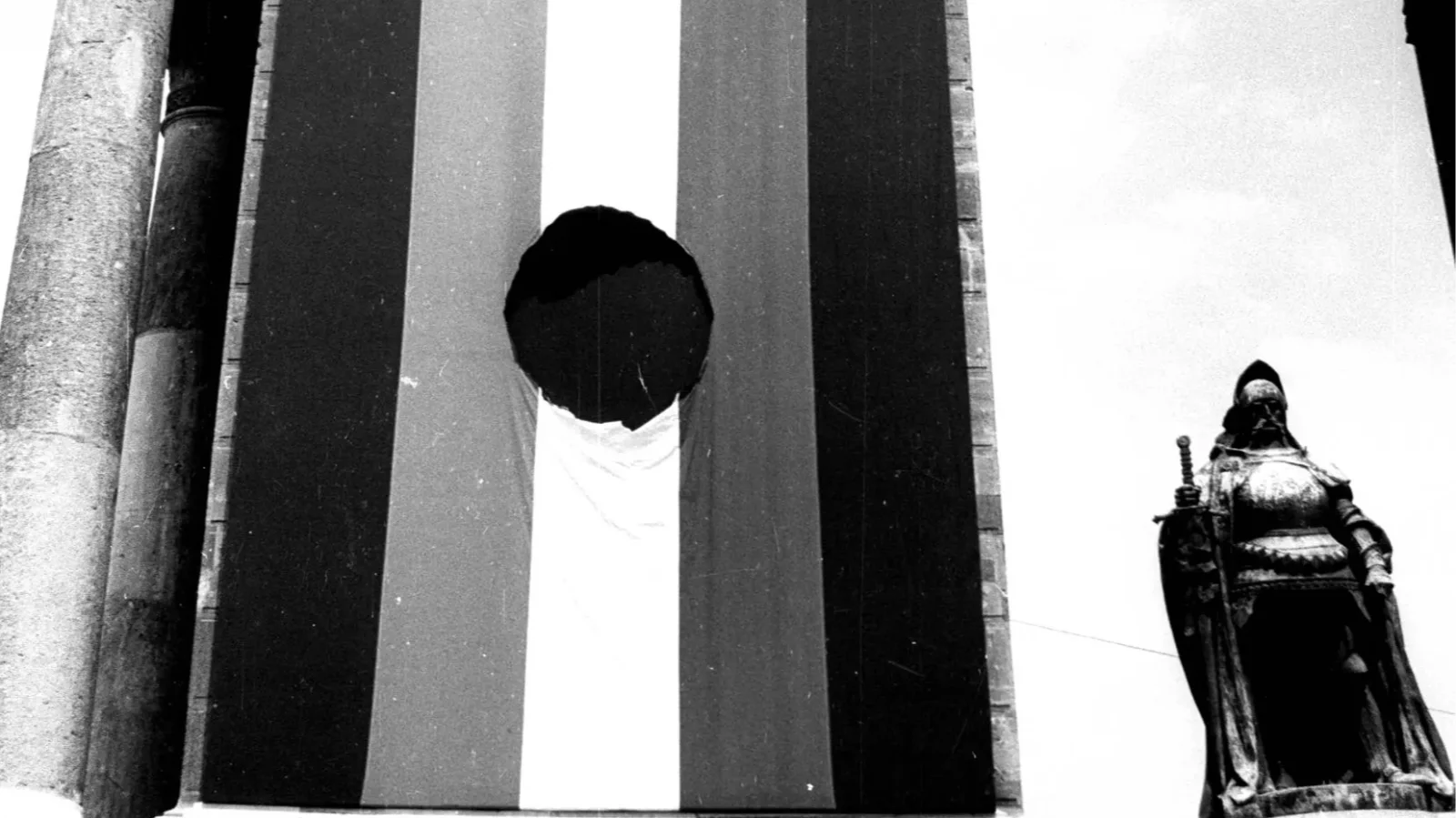

Mi Hazánk rallied in Debrecen with a direct message: "Justice for foreign currency loan victims." Their appeal was straightforward. This crisis tests whether Hungary defends its people or protects foreign banks that built fortunes on deception.

In response, government-aligned economists warned of instability. Markets might fluctuate. Public debt could rise. Lending could shrink. Property values might drop. These familiar warnings reveal Fidesz's priority: system stability over individual justice.

Real families bear the consequences. Thousands live one court order away from homelessness. Children are pulled from school. Grandparents face eviction from homes they hoped to pass down to their descendants.

A typical case illustrates the human cost. In 2007, a Hungarian family borrowed 8 million forints to buy a modest home in Szeged. When the Swiss franc surged, their monthly payments jumped from 45,000 to 78,000 forints. The husband took a second job. The wife cleaned office buildings at night. They sold their car and canceled the children's piano lessons. Despite every sacrifice, the bank repossessed their home.

This story multiplies across Hungary. Mi Hazánk's uncompromising stance resonates because it matches the scale of this betrayal.

Fidesz built its voter base claiming to defend Hungarian interests against foreign interference. Its handling of the currency loan crisis tests whether any of that commitment was genuine. Voters who once believed this populist message may now question why their supposed champions protect foreign banks over Hungarian families.

Mi Hazánk sees an opening. While Fidesz negotiates with international finance, Mi Hazánk demands complete justice for Hungarian victims. The message resonates with voters who feel betrayed by mainstream conservative promises.

Additionally, momentum from the European Court ruling is growing. Hungarian courts must now enforce EU consumer protection standards, and thousands of contracts could be invalidated. Banks may be forced to return profits made through these unlawful lending practices. The question is whether Budapest will lead the process or be dragged into it.

Fidesz promised action three months ago. What it delivered were committee votes blocking concrete relief with procedural delays. Fidesz leaders continue speaking about protecting Hungarian families while voting against measures that would accomplish this much needed assistance to Hungarian families.

The contradiction is stark. Fidesz campaigns on defending Hungarian sovereignty while allowing foreign banks to dictate terms to Hungarian households. It claims to stand with ordinary citizens while shielding the institutions that exploited them. Anti-elite rhetoric rings hollow when elites receive legal protection.

Mi Hazánk proposes a different approach. It wants to bypass court litigation entirely, and void abusive contracts automatically. Establish compensation funds paid by the banks themselves. No lawsuits. No uncertainty. No special treatment for lawbreakers.

The stakes extend beyond banking. Hungary's response reveals whether Fidesz’s sovereignty rhetoric is genuine or simply performance. A government that truly puts Hungary first would choose citizens over financial institutions.

Some banking insiders claim Fidesz selected cosmetic fixes over real reform. The calculation appears to be that drawn-out negotiations and slow court processes will cool public anger without touching bank profits. This represents a risky bet as Hungarian voters observe growing gaps between Fidesz populist rhetoric and their gentle treatment of financial institutions. Mi Hazánk offers something different: rhetoric backed by action, comprehensive protection regardless of banker demands.

Working-class neighborhoods understand the message, where foreclosure papers arrive weekly. "The government has again proven that it has abandoned the victims of currency fraud," Mi Hazánk said after the committee vote. "It does not want a real and final solution."

Critics worry about market chaos and budget shortfalls from mass restitution. Supporters respond that abandoned victims create deeper inequality, broken institutional trust, and meaningless sovereignty claims.

Two visions compete. Mi Hazánk envisions a state that prioritizes citizens, even when foreign investors object. Fidesz wants stability that keeps international money satisfied while managing domestic anger through gradual reform.

Bank executives collected bonuses from products that Europe's top court later declared illegal. Hungarian families lost houses to loans that violated EU law. Fidesz runs parliament but refuses to act.

The Debrecen rally captured Mi Hazánk's approach. Deputies spoke about defending Hungarian families against foreign financial warfare. Direct language, clear message: sovereignty means nothing if citizens remain subordinate to foreign banks.

While Mi Hazánk demands action protecting Hungarian families from predatory foreign finance, Fidesz delivers speeches about sovereignty while protecting the very banks that betrayed Hungarian trust.

The damage continues. Banks process foreclosures. Executives collect payments. Hungarian families lose homes to loans the European Court declared illegal. Parliament could stop it but refuses.

Hungary faces a choice. Protect people from predatory finance or protect the financial system from popular demands for justice. Mi Hazánk has chosen. Fidesz has not.

The test is clear. When foreign banks that broke the law demand protection from Hungarian politicians, what occurs? Fidesz has demonstrated their answer. Mi Hazánk offers an alternative.

Sources: Mi Hazánk Mozgalom, Magyar Jelen

Az X- és Telegram-csatornáinkra feliratkozva egyetlen hírről sem maradsz le!Mi a munkánkkal háláljuk meg a megtisztelő figyelmüket és támogatásukat. A Magyarjelen.hu (Magyar Jelen) sem a kormánytól, sem a balliberális, nyíltan globalista ellenzéktől nem függ, ezért mindkét oldalról őszintén tud írni, hírt közölni, oknyomozni, igazságot feltárni.

Támogatás